Leading the Way in Payments Innovation

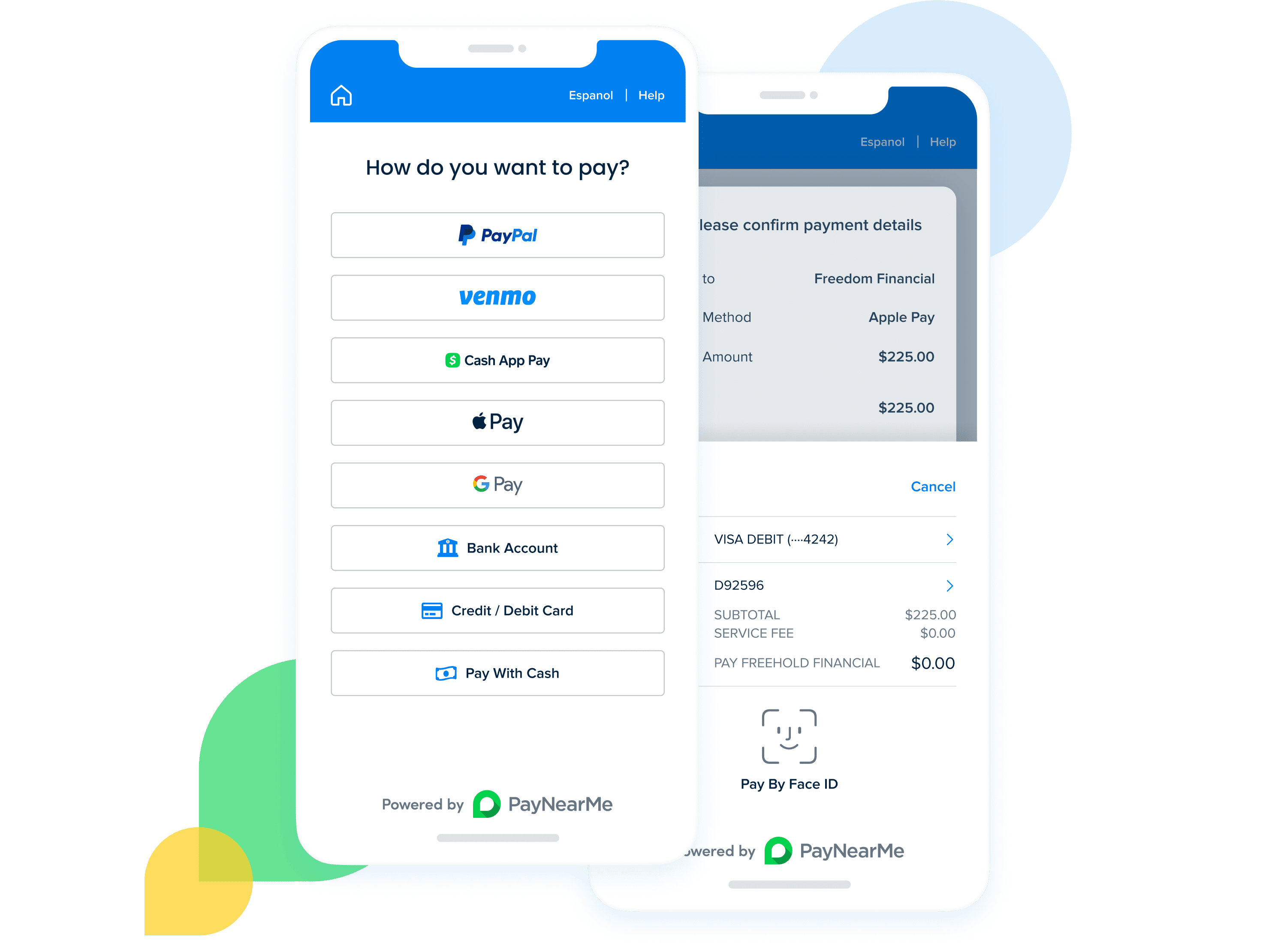

PayNearMe uses the latest, most secure and reliable technology to tackle the biggest challenges in payments.

Every payment. Every time. It’s our promise to you.

Making payments should be quick, reliable, easy to do, and easy to implement. That’s why our team of technologists, builders and innovators came together—to make the payment process better. Every time.

Originally launched in 2009 to process cash payments through retail stores, PayNearMe now processes billions of dollars annually via all payment types—cards, ACH, cash and mobile-first payment methods including Apple Pay, Cash App Pay, PayPal, Venmo and Google Pay.

Member Organizations

Schedule Your Demo

Experience the PayNearMe difference with a live demo.

Back

Back